Fundwise allows to raise capital through SPV. But what is SPV and what should investors take into account?

29. november 2018

SPV is an abbreviation of single/special purpose vehicle. It is a legal entity established for some “special” activity: e.g., for consolidating crowdfunding investments.

SPV as an intermediary

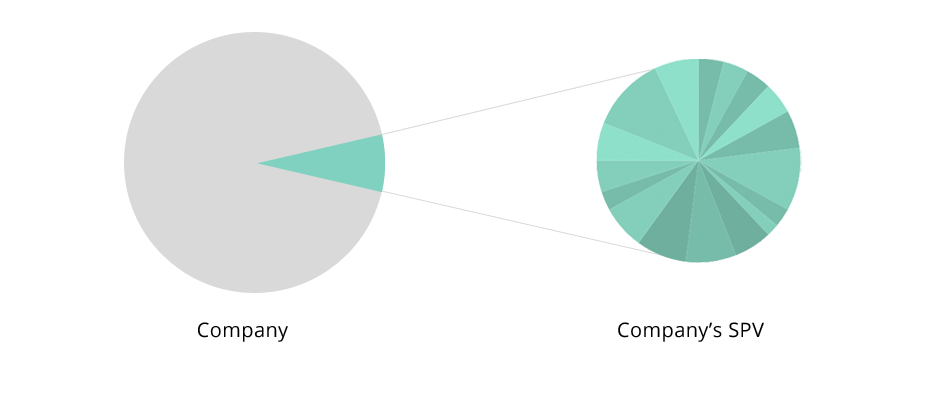

If, under a traditional scenario, an investor (a natural or legal person) invests and gets a share directly in the company, which is raising capital, then under an SPV scenario the investor receives a share in the SPV, whose sole purpose of existence is to acquire a share in the company, which is raising capital, and successfully handle this share in the future. The SPV doesn’t have any other operations or goals.

Why to establish an SPV?

There can be different reasons for establishing an SPV. The tradition of founding SPVs originates from tech companies, which were planning exits or new financing rounds right from the very beginning of their life. It is administratively easier to sell a company or start a new funding round with a shorter list of shareholders, where a bigger number of minority shareholders is consolidated under one legal entity. An SPV, which consolidates the capital of many minority shareholders, acquires, as one shareholder, a share of the parent company and gets registered as one shareholder in the list of shareholders. Without the SPV, the same share would have been acquired by many minority shareholders.

An SPV can also be necessary to handle crowdfunding campaigns of companies, which start raising capital abroad because such campaigns cannot be launched in their home jurisdictions due to legal or other restrictions. In such cases the SPV is founded in the country where the campaign is launched and after the end of the campaign the SPV acquires a share in the operating company.

What should investors take into account?

An SPV is an investment intermediary, which can be conditionally regarded as a union of investors. The SPV will be represented by a lead investor. The use of such an intermediary is justified by the simplicity of handling the investment. At the same time, there are also some extra management and accounting costs related to establishing and maintaining the SPV.

When an investor acquires a share in a company, the investor has to communicate to the company personally and take part in the shareholders’ meetings. In some cases this may be inconvenient both for investors and for companies, which launch campaigns on crowdfunding platforms and after the campaign have to deal with a very big number of shareholders.

Pluses for investors:

- Decreased administrative burden since the representative of investors handles bureaucracy

- The lead investor unites all the minority shareholders (who have same interests) and make them sound as one louder voice.

Minuses for investors:

- Neither individual investor has a personal right with respect to the company, but the SPV as a whole represents all the investor rights.

- Additional management and accounting costs related to the establishment and management of the SPV should be considered. It should be agreed who will cover these expenses: the company, which is raising the capital, or the investors.

Pluses for the company raising the investments:

- Shorter list of shareholders (this may simplify communication to financial institutions)

- Less members at shareholders’ meeting.

Minuses for the company raising the investments:

- In fact, the communication burden becomes bigger because it is necessary to make sure that the representative of investors forwards the information.

- Additional management and accounting costs related to the establishment and management of the SPV should be considered. It should be agreed who will cover these expenses: the company, which is raising the capital, or the investors.

As the name suggests, an SPV is a company established for special cases and the need for such companies arises in specific situations. Under usual circumstances, SPVs are not necessary for launching equity-based crowdfunding campaigns and investors can obtain shares directly in the company.