Real Estate Investment in The Netherlands

2 914 € (0%)

of 2 115 000 - 2 350 000 € goal funded

1 128 € minimum investment

Quick Pitch

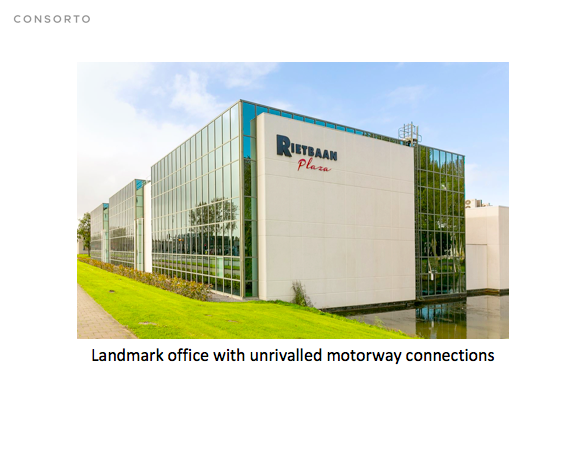

A commercial real estate investment opportunity in Rotterdam

Take the opportunity to acquire a leased office complex with EPC Energy rating A in Rotterdam - The Netherlands! The port of Rotterdam is the largest port in Europe and 10th largest in the world. The property benefits from exceptional transport links and is strategically located within 40 minutes drive to all major cities in Holland (Amsterdam, The Hague, Utrecht). The building is a landmark office with unrivaled motorway connections and has 4,446 m2 of net rental office space. The anchor tenant has just renewed its lease for another 3 years.

Problem & Solution

The European commercial real estate market stands desirable to investors worldwide. Through the Fundwise platform, we, a team of seasoned real estate professionals, offer private and institutional investors an opportunity to co-invest in commercial real estate property in Rotterdam (The Netherlands) with a relatively small ticket size. Investors can now participate in a low-risk investment that offers steady yield and attractive capital growth in a well regulated market.

The details of the investment opportunity are as follows:

- Acquisition of an office complex and securing new tenants to fill up at least 90% of the 1,000 m2+ vacant space

- With targeted marketing and by using our network, we will sign up new tenants in the coming 6 - 9 months to increase the rental revenue to €350,000.00 per annum - offering a 9.16% yield.

- We exit from the investment by selling the property in 3-5 years, based on the most favorable market conditions.

Product/Service Details

Location: The Rietbaan 2-6, Capelle aan den IJssel

Type: Office building

Offices: 22

Buildings: 3 (nr 2, nr 4, nr 6)

Floors: Ground + 2

Parking: 73 spaces for rent

Size: 4,781 m2 (gross rental office space)

4,446 m2 (net rental office space)

Tenant summary:

#1 €106,423 (leaving end of 2018)

#2 €169,705 (until 2021)

#3 €58,170 (until 2023)

#4 vacant space 980 m2

Business model

The investment opportunity has been found through Consorto (www.consorto.com). Consorto is an online marketplace for European commercial real estate. Consorto's goal is to bring this mostly off-market multi billion Euro industry online and save industry professionals time and money. It is a simple and efficient solution that automatically matches buyers and sellers and shares data between them.

Philip Verzun (www.verzun.com), one of the founders of Consorto, has 15+ year-experience in managing real estate projects. Together with his Dutch cooperation partner Ramón Luitwieler, Philip will also coordinate this project and ensure that the property is managed efficiently.

The structure of the project is as follows:

- Formation of an Estonian special-purpose vehicle, through which investments will be raised (already done: Rietbaan Plaza Oü)

- Formation of a Dutch company (B.V.), which will be a 100% subsidiary of Rietbaan Plaza Oü

- Acquisition of the property on the name of the Dutch company

- Payment of the funds raised directly to the Dutch Notary (from there to seller)

- Signing the loan agreement and transfer of lended money also directly to the Dutch Notary

- Signing new agreements between the Dutch subsidiary of Rietbaan Plaza Oü the property management company in the Netherlands

- Appointment of a Dutch real estate broker to secure new tenants for vacant space

- Collecting rent and signing new tenant agreements

- Paying out annual rental dividends to investors

- Selling the property in 3-5 years with a capital gain

Market

2017 was an exceptionally good year for the Dutch economy, with an outstanding 3.3% annual GDP growth. It is expected that new, business-friendly government policies will further stimulate sound economic fundamentals in 2018. The Netherlands was the third largest real estate investment market in continental Europe during Q1-Q3 2017. Rotterdam is home to over 47,500 companies, of which 1,200 are international firms. Amsterdam, The Hague, Utrecht and Rotterdam were among the top 10 most lucrative cities for investors in European real estate in 2017, according to research by Dutch consultancy Sweco (formerly Grontmij).

”2018 to be record year for investments in Rotterdam offices.” CBRE (refer to a report attached under the Documents section)

Traction & Accomplishments

International Real Estate Award winnning management with 25+ years combined experience in sourcing and managing small and medium size real estate assets for individual and corporate investors. Over the years, we have built-up an extensive worldwide network of real estate industry professionals and owners that allows us regular and early access to property offerings and full assistance by on the ground experts. We have managed a number of notable property sales, including land, villas, apartments, residential and commercial buildings. Our selected partners:

- Rotterdam; Broker “De Mik” http://rotterdam-bedrijfshuisvesting.nl

- “Goud” leasing broker: http://www.goud-bhv.nl

- “SBF” valuation services http://sbfmakelaardij.nl

How We’re Different

- We have created an online network for verified buyers and sellers of commercial real estate.

- We have built a smart platform that uses automation to connect with relevant leads for faster and more efficient deal making.

- We are a creative full-service real estate investment management team offering access to off-market property deals with secured private funding.

- We are offering innovative and personalized services to individuals and corporate investors who want to acquire or sell low risk commercial properties across Europe.

Uses of Funds & Timeline

- raising funds until end of November-December 2018

- sales and purchase agreement negotiations during December 2018-January 2019

- funds will be paid to the Dutch Notary in January 2019

- loan agreement signing and loan gets paid to the Dutch Notary in January 2019

- building acquisition by the end of January 2019

Obligations to Investors, Profit Distribution

Investors will own a share of this real estate asset via pro rata shareholding in the asset holding company. Our proposed revenue model RENT + CAPITAL GAIN

- annual dividends from rental revenue

- capital gain from selling the property

Risks and Mitigation

The anchor tenant is signed up until 2021 with an option to renew the lease and they have been in the premises since 2007. We have secured a loan from private lender in The Netherlands under the following terms:

Amount: 1.6 million euro

Security: first mortgage on the property

Term: 5 year

Annual repayment: 50,000 euro to be paid annually afterwards

Intrest per year: 5 % to be paid annually afterwards

Commission: 0.8 %( deducted from the loan)

Payments: via the account of the notary

Applicable law: The Netherlands

After a 1 year track record we will source refinancing under better terms. We will appoint a reputable local property manager for the building. We will engage market leading rental brokers to speed vacancy filling.