Kanvas.AI Campaign

13 087 € (13%)

of 100 000 - 300 000 € goal funded

100 € minimum investment

Quick Pitch

Our mission is to make investing in art accessible for everybody, by offering the necessary technology.

Kanvas.AI is a data-driven platform, giving artists and galleries the tools to manage their content and for investors the tools to invest in art by offering both traditional and alternative payment options (eg crypto), and a secondary market for trading physical art. We have also built an Estonian Art Index, a powerful tool to help investors understand how art has grown in value over the years and make it easier to find the next Picasso to invest in. We recently launched a Web3 platform to offer the same tools for digital art.

The goal of this campaign is to raise funds to implement fractional art investing by making investing in art as easy as entering the stock market, starting with as little as 10€, to complete the development of the European Art Index and expand to new markets.

We are looking to raise 100k€ up to 300k€ to take Kanvas.ai to the next phase of the company.

Background and History

Art is an alternative investment class that Kanvas.ai is making more accessible. If anything makes the world a better place, it is art! But in addition to its emotional value, a correctly chosen artwork can also be a very good investment. Kanvas.ai was founded in February 2021 when we launched our beta platform.

The initial goal was to provide artists and art enthusiasts with access to constantly evolving technology by making art available in the digital space where there are no national borders. Our founding members have a long-standing background in the art market and technology.

Seeing how the whole world and artists are searching for ways to make art more accessible, it was important for us from the outset to maintain quality in our environment and offer only a curated selection of art. The first year of Kanvas.ai was about growing our team and testing the market.

We developed artist interfaces and admin tools for galleries, tested different technologies such as AR and VR, and added a crypto payment solution for our clients, as well as the ability to pay in installments. In addition to physical art, we also introduced a number of NFT projects on our platform.

Since we did not have the means for blockchain development at that time, we used other platforms, which gave us a very good practice and overview of the advantages and disadvantages of this medium. In the realm of physical art, we collaborated with various galleries and exhibition spaces thereby raising their visibility, and participated in the Technopol incubator and a few hackathons. Most importantly, in our first years we have been able to attract a decent list of professional artists to the Kanvas.ai environment.

Today, after 2 years of Kanvas, we have completed the development of the first version the Estonian Art Index which has received positive reception from both galleries and collectors. In addition to the physical art environment and collector market, we also have a NFT minting and selling platform which we recently launched using Tezos blockchain technology which makes us unique in the Central Eastern European and Nordic regions. We have been able to find the right product market fit - to bring art collecting and investment to a broader audience, and now we are preparing to scale our business model internationally.

Problem & Solution

Artists and galleries lack the tools and means for moving their business into the exponentially growing field of web sales.

Today we can offer artists and galleries the administrative tools and solutions for web exhibitions. We are also working on adding automated marketing tools. For the collectors we have our secondary market in which it is possible to store, sell or auction their art. For those dealing in NFTs we have now opened the nft.kanvas.ai environment.

For many investors, NFTs might have gotten a negative connotation. Yet, the medium has an important and continuously growing role to play in the art world. The NFT platforms on the market right now are concentrated only on digital art and most of them lack curators as well as respectable user agreements that would also protect the authors. The Kanvas.ai blockchain features curated art from numerous successful digital artists for whom the platform offers both protection and transparency.

Art as an alternative asset class that is unobtainable for people not versed in art nor having the funds for investment.

Astrid Laupmaa, the founder of Kanvas.ai, having experience as a gallerist and working with many international artists and collectors, has frequently come into contact with people wanting to invest in art but not having the idea of where and how to start. In fact, most such people never come into contact with a professional art advisor. In addition, the cost of art is unattainable for many as allocating 5,000-20,000€ on a single piece is often a risk too great, but we already offer the ability to pay in installments.

As a solution we have developed Kanvas Art Index - a tool that can help understand art in simple numbers, without needing to have prior knowledge in the art market. For now we have released the Estonian art index in which there are gathered and visualized the data from the last 20 years of public art auctions. Separate from that is an index based on the Estonian Haus Gallery data and in short order we are coming up with the European art index.

The Estonian Art Index makes Estonian art also comparable and comprehensible for foreign investors (and vice versa).

Since the problem of the unobtainable high price and illiquidity of art has thus far not been solved, we have now decided to include you in offering a fractional model. There are successful global models with a proven business model in this space such as Masterworks.io in the US.

Product/Service Details

Our goal is to make investing in art accessible for everyone who is interested in starting to invest in it. Kanvas.ai offers various tools for galleries, artists, and investors. We have strong legal documents that protect the interest of both the artist and the investors.

For galleries and artists:

-

Primary market - easy to upload and list the artworks

-

Administration tools - users have full control over their artworks and profile. Artworks can be set to private or uploaded to the market, allowing full control over when and which artwork is available.

-

Online exhibition space - a customizable online exhibition page that is easy to set up

-

Blockchain technology - irrefutable digital record and certificate for both physical and digital art

-

Online marketing tools - all necessary tools to showcase artwork

For collectors:

-

Secondary market and fractional investment - an easy way to resell artworks and connect with a network of collectors

-

Customized collectors' profile - full control over who can see their collection, with the option to make it visible to everyone or send invitations with private viewing links

-

Kanvas.ai Art Index - Kanvas.ai's art index is a database created based on Estonian art auction sales history of the last 20 years (2001-2021), with an aim of making art and investing in art easier to understand for anyone interested. See the next section for more detail.

Kanvas Art Index

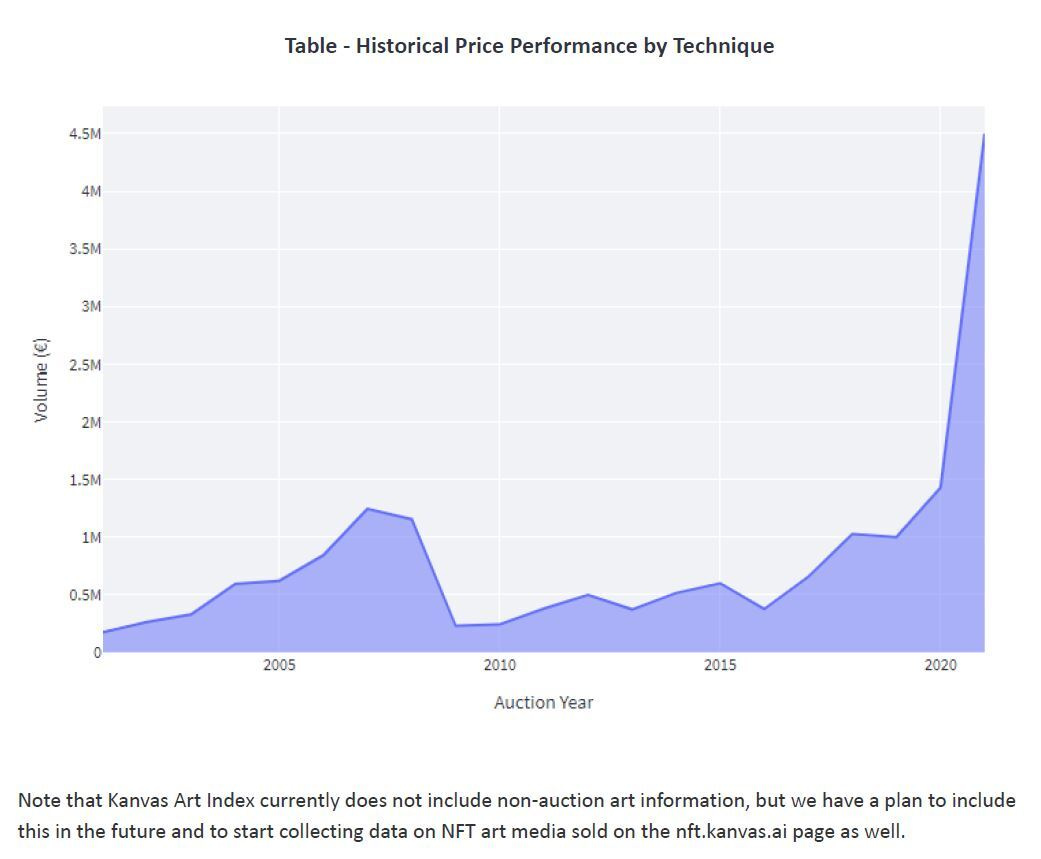

The Kanvas Art Index data has been collected based on the results of the public auctions of the main galleries in Estonia, which provides an overview of how the art market behaves over time and which art mediums and authors have the best investment performance.

Based on the data, it is clear how the popularity of art has taken a big leap in recent years, both in terms of prices and volume. For example, for many types of art work, the price increase or performance has been over 10% a year. Hence, a well-chosen piece of art is a good choice to protect your money against inflation.

Below are some sample summary data from the index. Please visit artindex.kanvas.ai to learn more.

Business model

The Kanvas.AI generates revenue via:

-

Brokerage / listing fee on primary market - if the art is purchased we charge 10%

-

Brokerage fees on secondary market - Kanvas.ai charges 3% from secondary market

Sales -

Commission fee from exhibitions - We are offering exhibitions for companies, co-working offices and other public spaces, all exhibited works are for sale and Kanvas.AI will charge a service fee and commission fee (10-30%)

-

Minting (listing)/burning fee - every minted or burned NFT is one XTZ for Kanvas.ai, even if this NFT is not going to be sold.

-

Custom solutions - we are also offering custom solutions for galleries, like personal artindex, collectors database

-

Subscription fees - subscription fees to collectors and galleries

Market

European Art Market

Kanvas.ai is focusing at the moment on the European and UK art market. Apart from art sales our business model is built on profit and service fees.

Our market is contemporary art and NFT art mix, plus service for galleries.

Currently there are around 19,000 galleries in Europe, approximately 60% galleries have 1-4 employees and no access or funds to build their own technology (see References below).

Online sales are growing exponentially and galleries are forced to implement hybrid models (physical + digital space).

Global Art Market

Aggregate sales by dealers and auctioneers reached $65.1 billion, soaring by 29% from 2020, according to the 2022 Art Basel and UBS Global Art Market Report.

The United States remained the largest single market, with sales rising by a third during 2021 to just over $28 billion. Though Greater China’s sales, which totaled $13.4 billion, grew by even more – just over one-third – it remained in the number two spot. The UK market grew by 14%, reaching $11.3 billion.

Auction houses experienced the strongest rebound, fueled by the newest art.

All sectors of the market grew from 2020 levels, but auctioneers saw the most dramatic recovery. Public sales increased by a remarkable 47% and private ones rebounded by about a third. The dealer market, by comparison, rose in value by 18% .

References

Below are some of the sources to the statistics mentioned above.

-

Masterworks.io - a leading fractional art investment platform (has raised 110m USD in venture funding)

Emerging NFT Art Market

There is a remarkable disparity, however, between the interest shown in NFTs by collectors and the seeming interest of traditional artworld players in selling them.

Some 88% of the HNW collectors that the report surveyed are interested in buying NFT-based artworks in the future. But among dealers almost half had not sold works in this format and said they had no interest in doing so, suggesting that they are content to let others reap the rewards.

And while public auctions have created splashy headlines, the total NFT sales for Christie’s and Sotheby’s for 2021 ($150 million and $80 million, respectively, totaling $230 million) amounted to less than the total price of the three individually highest-priced works they sold in the same year ($288.7million for the aforementioned Picasso, a Basquiat, and a Botticelli).

Traction & Accomplishments

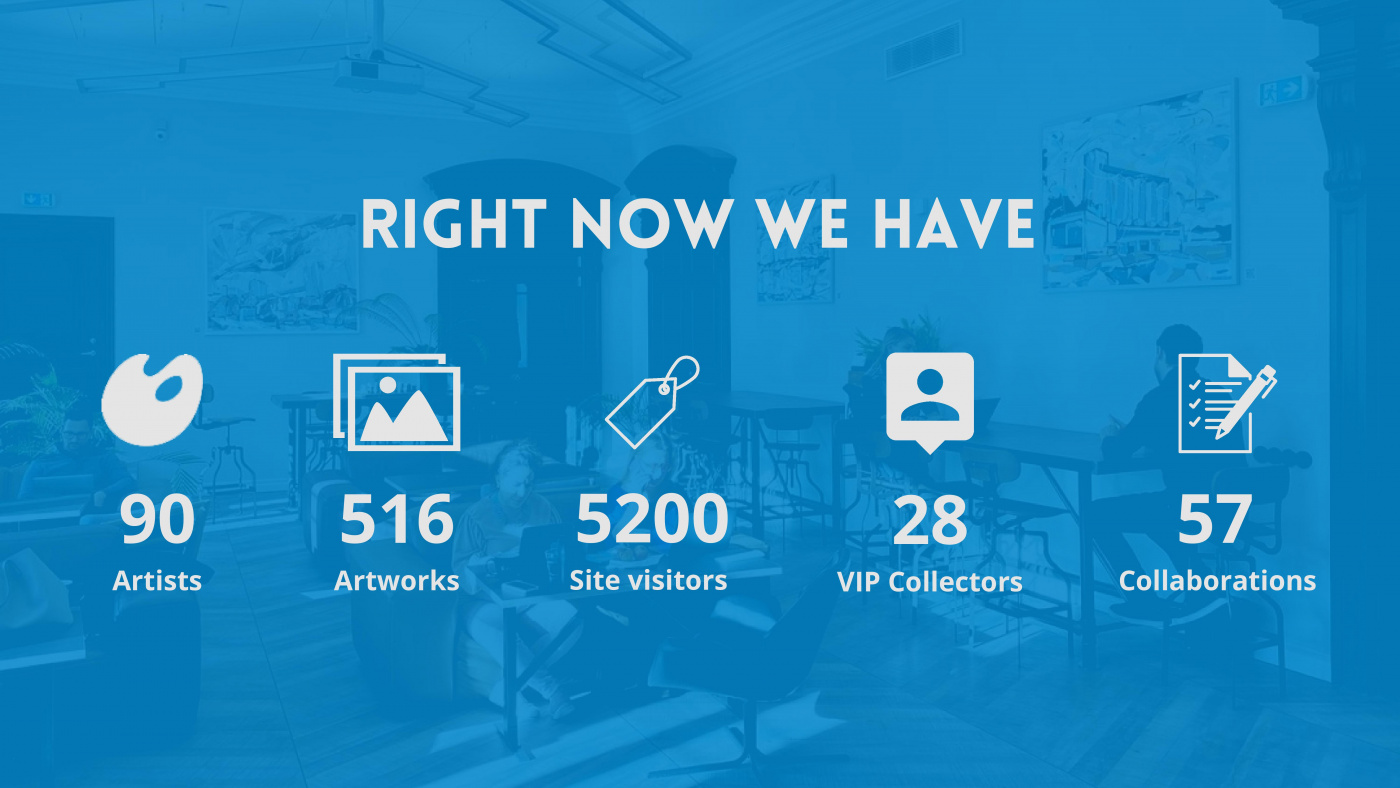

We launched Kanvas.ai beta in February 2021 and we have been testing the market and modified our business model since then. Below is a short summary of accomplishments to date:

-

Artist community - we have gained the trust in our quality and more than 80+ professional artists have joined with Kanvas

-

Art Index and analytics - in autumn 2022 we launched Estonian Kanvas Art Index.

-

Hackathons and incubators - we have participated in several hackathons and Technopol incubators.

-

Team - Kanvas.ai has a strong team with inhouse developers.

-

Tezos Investment - we were the only art platform in Central Eastern Europe and Nordics to receive investment from the Tezos Foundation

-

Blockchain - we launched our blockchain in March 2023 and became a part of Tezos international art community, including cross marketing and partnerships

How We’re Different

First of all: We have a great team and energy that is still motivated and delivered a lot with a low budget. We all believe in our business and there is no way that we will give up to grow big.

About our business model:

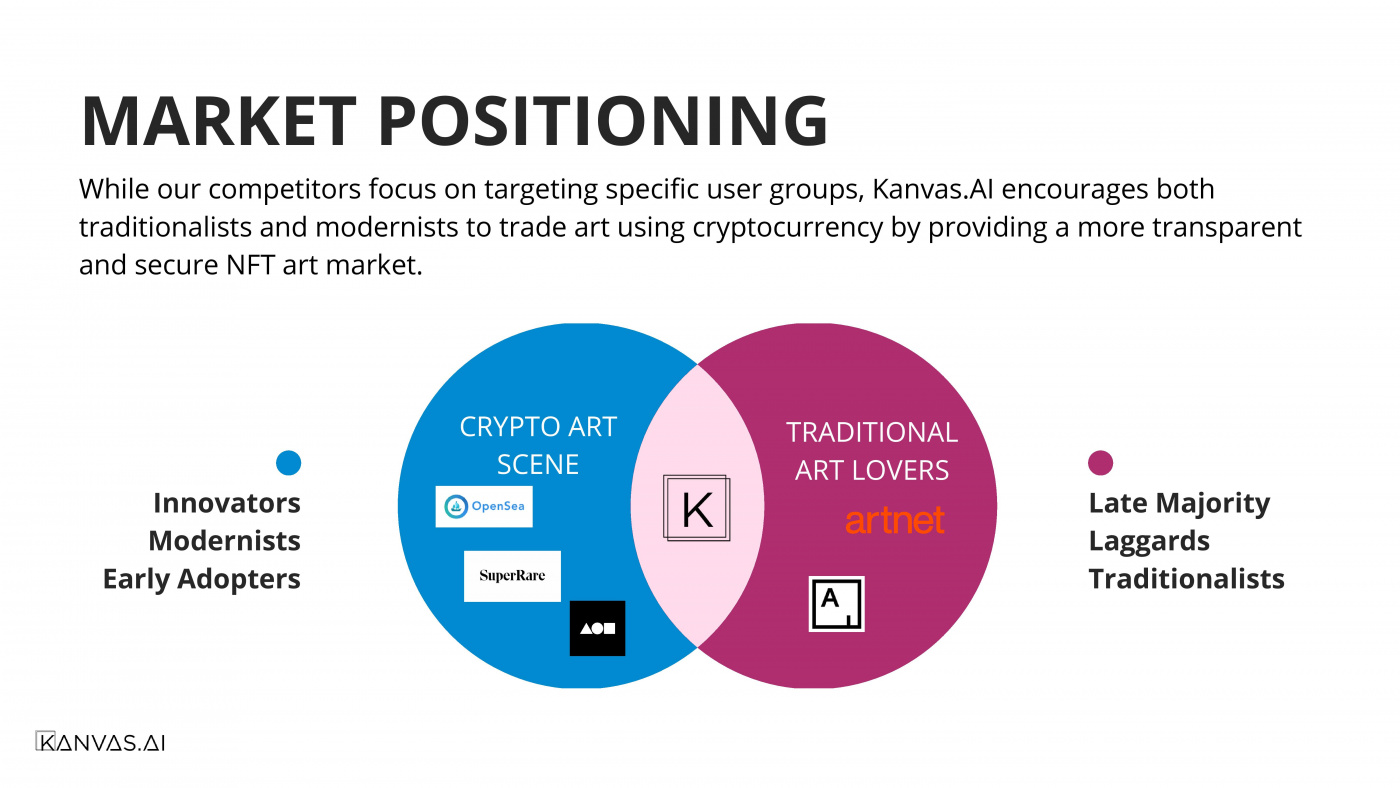

If most marketplaces are either only for physical or NFT art, then we are giving access to both mediums.

Kanvas.ai is placing itself as a bridge between the traditional art market and new generation NFT art market.

We are not just offering technology, but we are also offering custom solutions for our clients and Artindex for our collectors.

We are following the art market and are adjusting our services according to that.

This is the reason we want to offer a fractional model to make artists fundable and at the same time give access to invest in it with low risks all around the world.

We believe that during these difficult times when most companies and assets are available worldwide online, then art should not be excluded.

Uses of Funds & Timeline

We plan to use funds raised with the following goals and timeline:

-

Fractional investments - we plan to upgrade our marketplace to offer technology for fractional solutions. As we are not changing our current marketplace, but adding an other option, so we need some upgrade in technology (Q3 2023).

-

Improved legal framework and blockchain smart contracts - in partnership with Sorainen law firm we create legal work and contract samples for our clients who want to trade with fractions. Our legal framework at the moment covers only physica, digital and NFT art, but not fractional models (Q2-Q3 2023).

-

International expansion - expanding to the international market. Onboarding ambassadors (Q4 2023 - Q2 2024).

-

Growing team - onboarding a new salesperson (Q2 2023)

-

European Art Index - completing the European Art Index on a more comprehensive database of art transactions (Q2 2023)

Obligations to Investors, Profit Distribution

You and your investment can grow with us.

All investors will be part of our VIP collectors club, which will include private advisory, discounts, access to new assets before public, and special event invitations. In our fractional model our collectors will get first access (before public) to invest in listed artworks.

For interested investors, we will also distribute a limited number of Kanvas tokens that can be listed in the secondary market anytime. The token design is currently under development but will most likely involve a utility or community token which will gain value through the transactions conducted on the platform.

Within 5 year timeline, Kanvas.ai will consider an exit plan will be a merger with a larger similar platform, interested in buying our customer base, brand, analytics and technology. There have also been a few IPOs with similar platforms such as Artprice which concluded an IPO in Paris.

Risks and Mitigation

For fractional model, there are lot of legal aspects which are different from other asset glasses. For example Estonia does not offer insurance for single artworks, and there maybe obligations to pay royality fees for some artists. Kanvas.ai has very strong legal partner Sorainen law firm which has lot of experience in art field (both digital and physical art). We have advisors in team who have been founding already successful fractional model companies.

Art can be long term investment, investors may have to wait 5+ years until they will make their profit. Some artworks can be harder to sell in secondary market than others. When works are going to be listed in auction, we dont have guarantee that particular work will perfom well. To lower that risk we are collaborating with professional art experts and selecting our portfolio wisely.

It is also very important to keep quality high and collectors trust, as main problem in online art sales is proof of originality. Once you lose your trust then you will loose your high profile artists. We have been building strong relationships with our artists and offering free consultation for them.

Art is popular for money laundring and we must keep eye on that. As Kanvas.ai is dealing with crypto and also art, then we have a higher risk to attract money laundring. To lower that risk we are keeping eye on transactions and our sales and will also be performing standard Know Your Customer (KYC) checks. Any suspicious move will be visible, if needed user blocked and IP address tracked.