LandEx

178 439 € (119%)

of 149 799 - 639 630 € goal funded

138 € minimum investment

Quick Pitch

LandEx is the first investment platform where everyone can easily invest in sustainable farm-and forestland. LandEx will unlock the true value of land by democratizing access to land investments.

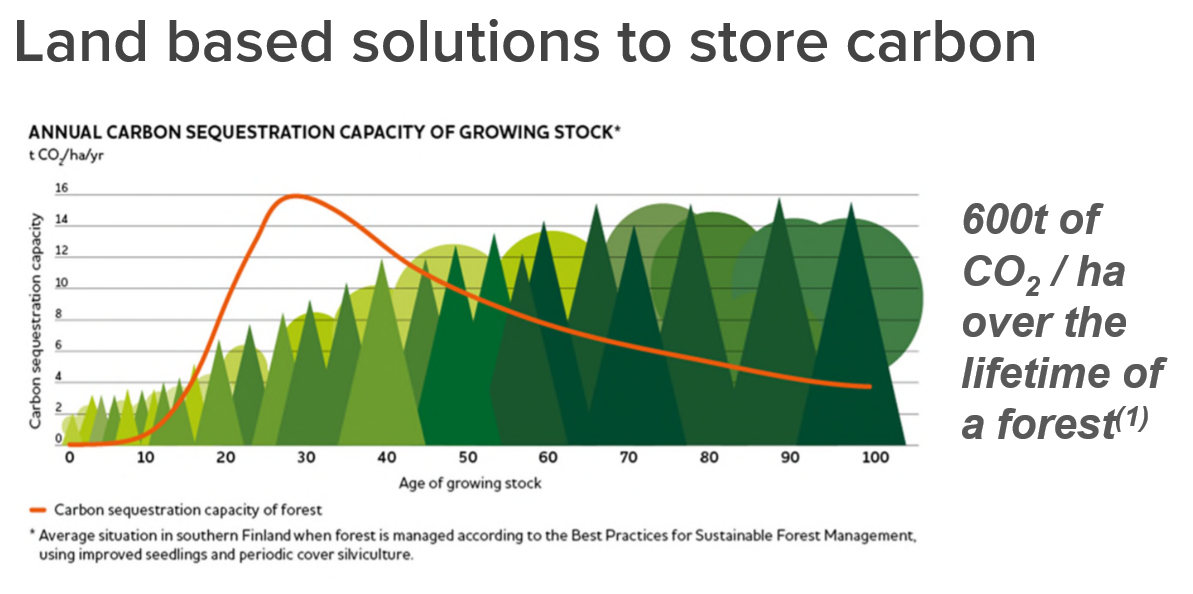

With carbon capture becoming a top concern for governments and companies around Europe, land-based carbon capture will add a new income stream to land owners, making land one of the best long-term investments going forward - we want everyone to have access to this.

We are a first mover in this market, starting a journey to digitise land for a number of financial services.

The goal of this fundraise is to build a small and focused team to develop new product features and build our community of investors.

Problem & Solution

Land Investments are high return low risk but retail investors have no easy market access.

We let everyone easily and directly invest in land.

Product/Service Details

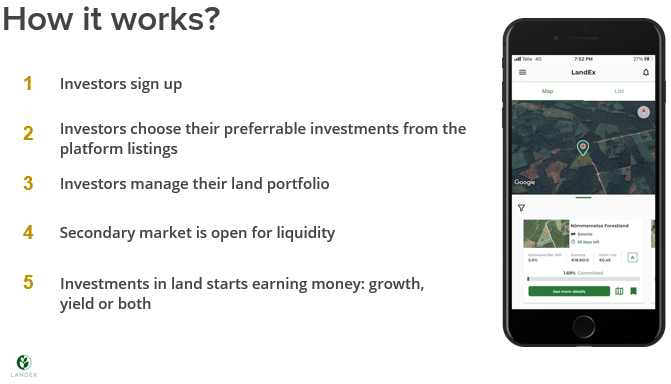

Investment platform where everyone can easily invest in farm- and forestland

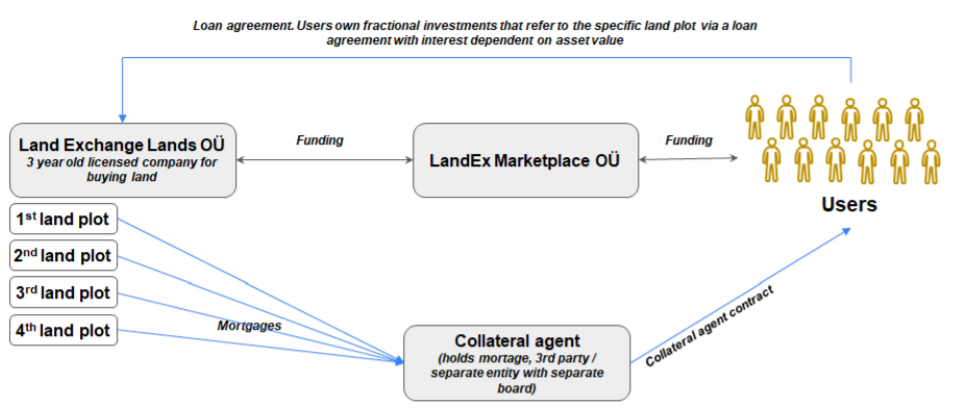

LandEx’s goal is to get the investor as close as possible to owning land, but legally “fractionalisation of land” is impossible, and we cannot also offer the investor ownership in the company that owns the land, as the regulatory cost would then go into millions of euros. We found a solution using the typical crowdfunding playbook, where a loan contract is used for investing. LandEx lands loan contract is with a changable interest, so that the value depends on the value of the asset and the investors benefits from the full increase of asset value. As the land has no other loans, there is no need to fear bankruptcy. The loan investment is backed by a mortgage set for that specific land which is held by a collateral agent.

Please see more by downloading our app.

Business model

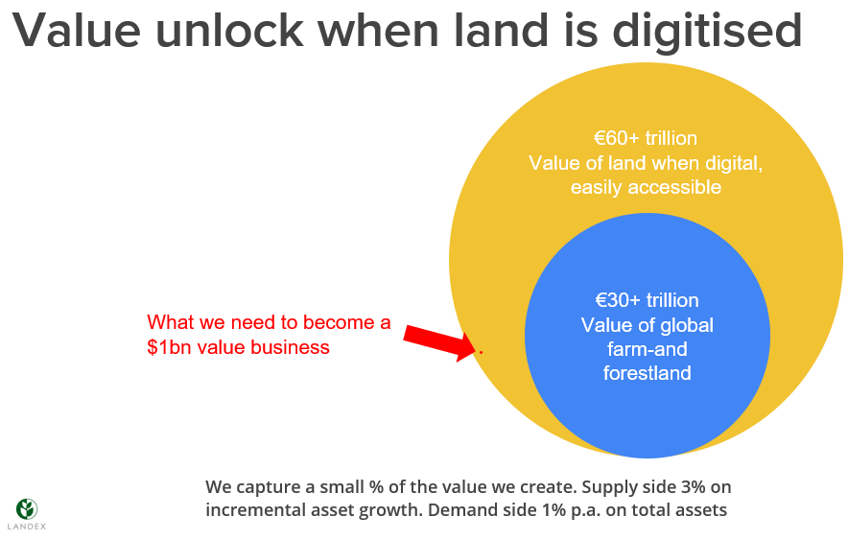

We take a small % of the value we create from both sides of the marketplace.

Investing on LandEx is free of charge. There are no fees for opening an account, depositing money, or withdrawing money. Small, transparent fees apply to exiting investments.

The platform will charge listing fees from the sellers to list lands on the platform and to cover transaction costs

1. Listing fee - 3%

2. Secondary market fee - <1%

3. Secondary listing fee – <1%

4. Final Exit – 20% of everything above 10% annual return

Market

Market analysis for LandEx requires 2 separate analysis: 1) How many users would like to invest with LandEx? 2) Will we be able to find enough land to offer to the users?

Users

Our potential client base is every person around the world that has €10 to invest in LandEx. Land has become a more popular asset class, so we don't think we'd be constrained by the number of potential investors.

Land

There's enough farmland and forestland sold every year in our current and future markets for us to have no supply issues:

1. Estonia: €150m every year

2. Finland: €500m+

3. Sweden: €750m+

4. Germany: €1bn+

Globally, farm-and forestland is worth €30 trillion and we believe that with land investing becoming easily accessible and fractional, we would see land values starting to increase on the LandEx platform.

We believe that LandEx land through ease-of-access, diversification and transparency could be seen as something that has yields similar to government bonds (0.5-2%), which means that current land prices have upside potential of 100-500% based on just adding ease-of-access and fractional investment (diversification).

Traction & Accomplishments

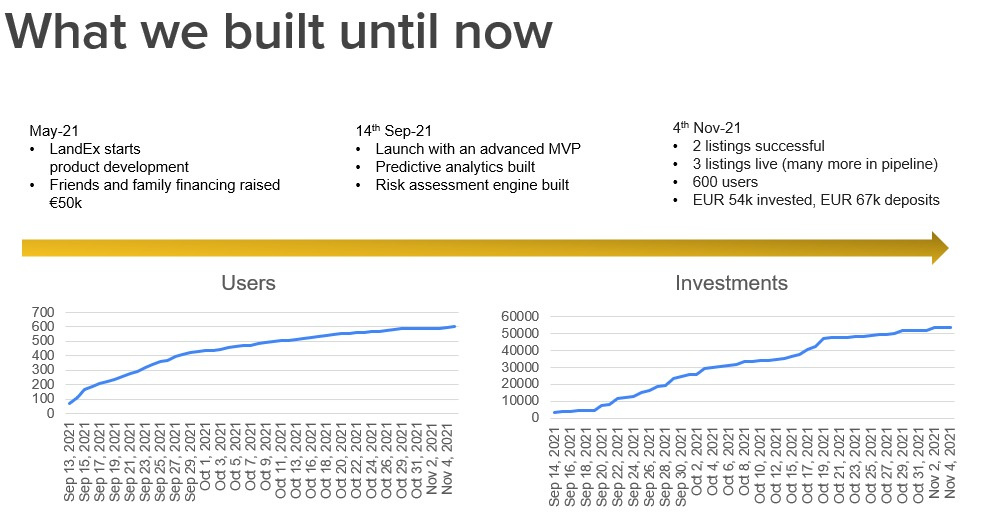

Launched 14 September 2021.

As of 4 Nov:

2 listings successful

3 listings live (many more in pipeline)

600 users from 14 countries

EUR 54k invested, EUR 67k deposits

How We’re Different

We're the first of our kind land investment platform which fractionalises land and provides easy access to all investors. There are a few similar companies like Acretrader or Farmtogether in the US, but they only allow access to large investors with over $1m of assets.

We are also using our carbon markets know-how to unlock carbon financing for the lands on the LandEx platform. Land-based carbon capture solutions are some of the cheapest and powerful ways to combat climate change.

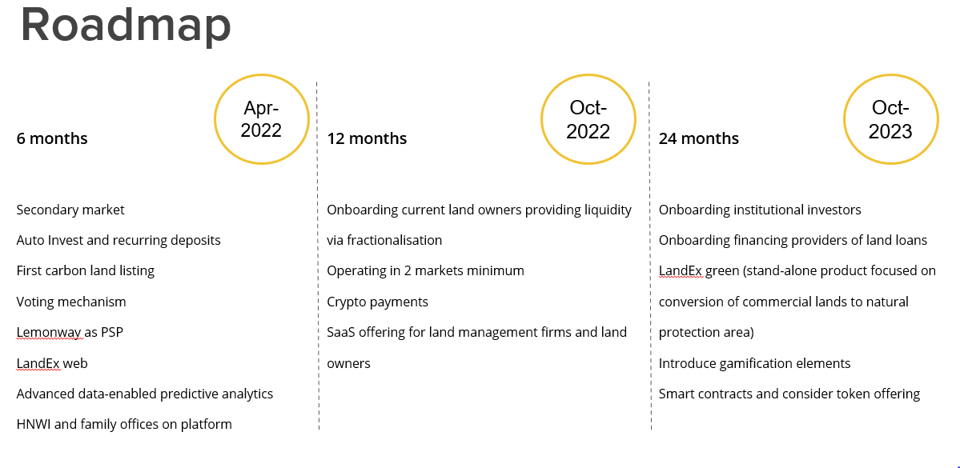

Uses of Funds & Timeline

Funds used for:

Building a small focused 8-10 people centralised team for quicker development and iteration with monthly expenditure of c. €25k. We will be hiring a community manager, operations specialist, web developer, a back end developer and a head of legal.

This would allow us to develop new product features like LandEx web, integration with payment providers, develop a voting mechanism, LandEx loans, SaaS offering to larger land owners, etc.

Community development and marketing with minimum of €2k monthly expenditure to educate potential users about land investments via Geenius and paid marketing on Google and Facebook, as well as direct sales to high net worth individuals and wealth management companies.

We will have runway for a minimum of 12 months and would consider a next fundraise in Q4 2022 if needed. We are planning to reach growth levels where we could survive without another fundraise by that time, so we could choose to fundraise not need to fundraise.

Obligations to Investors, Profit Distribution

Investors become holders of equity shares with all the associated rights.

As early stage company in huge market our primary task is to grow. We do not foresee being in position of distributing dividends in coming years.

In the long-term, LandEx will consider dividend distribution if we don't see no further need to invest in the growth of the business. We will also consider an IPO and being acquired if an attractive offer is received.

Shares will be tradable on Ignium peer-to-peer market.

Risks and Mitigation

Risk of change of company's plans, markets and products

The success of startups in the technology industry will likely be dependent on the strength of the overall technology industry, which is characterized by rapidly changing technology, evolving industry standards, new service and product introductions and changing customer demands. The changes and developments taking place in this industry may require the company in which investors invest to reevaluate its business models and adopt significant changes to their long-term strategies and business plan. The failure of the company to make such changes would materially adversely affect the business of the company, and potentially have a material negative impact on the returns of investor’s investment in the company, including potentially a complete loss of investment.

Company has limited operational history

The company is still in an early phase, and is just beginning to implement its business plan. There can be no assurance that it will ever operate profitably. The likelihood of its success should be considered in light of the problems, expenses, difficulties, complications and delays usually encountered by companies in their early stages of development, with low barriers to entry. The Company may not be successful in attaining the objectives necessary for it to overcome these risks and uncertainties.

Additional funding that the company may need could not be available

The company may require funds in excess of its existing cash resources to fund operating deficits, develop new products or services, obtain activity licence, establish and expand its marketing capabilities, and finance general and administrative activities. Due to market conditions at the time the company may need additional funding, or due to its financial condition at that time, it is possible that the company will be unable to obtain additional funding as and when it needs it. If the company is unable to obtain additional funding. If the company is able to obtain capital it may be on unfavorable terms or terms which excessively dilute then-existing equity holders. If the company is unable to obtain additional funding as and when needed, it could be forced to delay its development, marketing and expansion efforts and, if it continues to experience losses, potentially cease operations.

Company's growth relies on broad market acceptance that may not occur

While the company believes that there will be significant customer demand for its products/services, there is no assurance that there will be broad market acceptance of the company's offerings. There also may not be broad market acceptance of the company's offerings if its competitors offer products/services which are preferred by prospective customers. In such an event, there may be a material adverse effect on the company's results of operations and financial condition, and the company may not be able to achieve its goals.

Company may not be able to acquire required activity licence(s) or this may take longer than anticipated

The company may need to obtain an activity licence to conduct its activities on a broader scale. Obtaining such a licence may be costly and require extensive time having a negative impact on the ability of the company to conduct its business or such licence may be denied for the company which may have negative effect on the business of the company.